Lunar New Year skyrocketed the sales of fresh food in Thailand

Being rooted in Europe, Lunar New Year has always been a bit distanced for us at datasapiens.

That said, we are increasingly more present in Asia. In 2022, we launched our platform for a third Thai retailer in three years. We are now providing our services to Makro, Tops, and BIG C, the key grocery retailers on the market. We are handling 8 million loyalty card customers monthly.

There are 70 million inhabitants in Thailand, with up to 10 million people of Chinese origin. This makes Thailand the largest overseas Chinese community in the world.

It is no surprise that the Lunar New Year is important for Thai people. We decided to analyze the consumption trends during this festive period. And share the insights with you, our readers.

FMCG sales in the period leading up to the LNY

The first day of the Lunar New Year begins on the new moon that appears between January 21 and February 20. This year, it fell on Sunday. January 22.

The period around the Lunar New Year can be split into three important days:

Pay day (Jan 20): A Day to go out and buy the necessary ingredients to prepare food for the next day. Especially meat, seafood, deli, ready-to-eat dishes, fruits & vegetables.

Worship day (Jan 21): A Day to pay respect to one’s ancestors. It is the last day of the old year.

Travel day (Jan 22): The 1st day of the new year

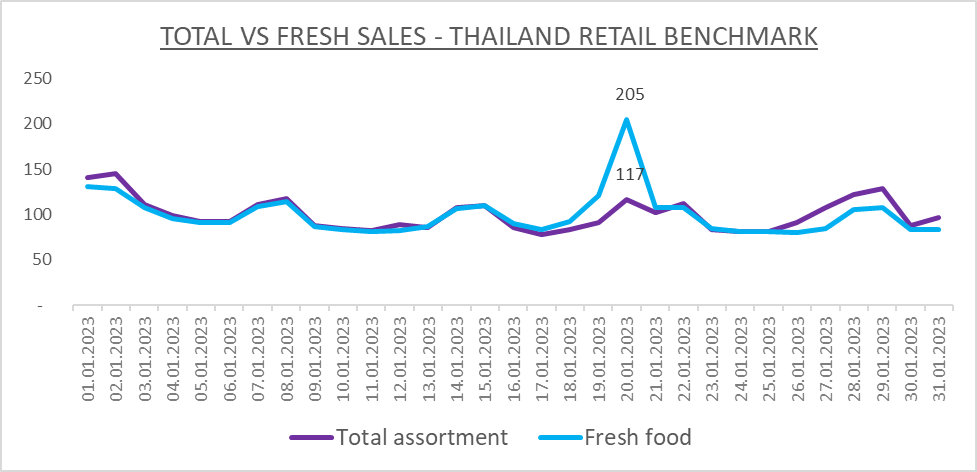

Look at the chart below. The total Thai FMCG sales are not much different from the average day in January. Fresh food, on the contrary, hits the peak on the “Pay day.” Reaching an index of 205, i.e., more than double the average Fresh food sales in January.

Note: Combining all 3 retailers, we have come up with a benchmark to generalize the trends. We also use indexes to compare the performance across categories of different sizes.

Diving into the Fresh categories, there are two that stick out: Deli and Fruit & Vegetables. These two product groups experience three times higher sales on the “Pay day” than on an average day in January.

Insights into fruit consumption

Going one level deeper, I decided to zoom into the Fruit & Vegetable category. It provides valuable insight into what sort of fruit Thai people buy for Lunar New Year. Taking pomelo as an example, this fruit class saw a sales uplift of 12x compared to a typical day. The customer uplift was comparable (11x). That means the increase came from new shoppers buying pomelos for the event.

On the other hand, bananas recorded a sales uplift of 9x and “only” tripled the customer base. The growth was driven by both new and existing customers purchasing higher quantities.

Our platform is based on customer loyalty data. It gives us the unique possibility to understand Thai consumers’ behaviour. Not only what they are buying. We also track what they put in the basket together. Which products they are switching from? Or what is the source of new shoppers?

For the following example, we took three fruit classes – pomelos, bananas and oranges. Leveraging our loyalty platform, we wanted to understand the cross-purchase of these categories.

In the period leading to LNY, 42,2 % of shoppers purchased only bananas but not oranges or pomelos. Another 9,7 % bought bananas together with oranges. But only 2,4 % of banana shoppers picked also pomelo during the pre-LNY period.

By knowing these insights, category management teams can better target their customers. Provide customized offers to stimulate sales, for example, by offering personalized coupons to shoppers.

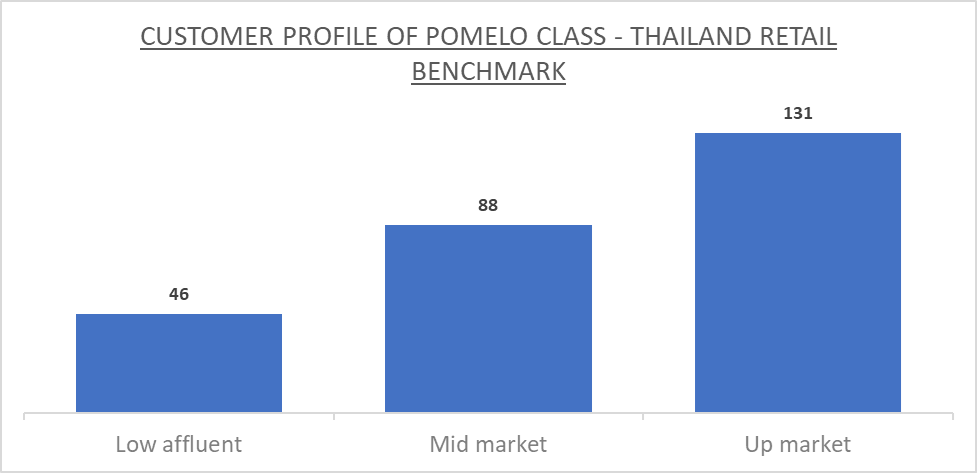

Having the customer data available, we can see who buys which category. We use indexes to compare the split between different customer segments vs the total. You can see that pomelo is skewed towards the upmarket customers. Low affluent pomelo shoppers represent less than half compared to an average basket.

This again helps to target the communication or promotions to the right audience.

We are happy to provide our customers with similar insights. The goal is always to help them serve their customers better.

Send us a note if you wish to see similar insights from your market